Prices of prime global rentals around the world fell by 1.1 percent during 2015 according to new research.

Knight Frank’s Prime Global Rental Index, which reported the decline, noted how equity market volatility and economic fragility in emerging markets were driving rents lower.

Taimur Khan, Senior Research Analyst, said: “Weak equity markets and record low commodity prices contributed to the Index’s weaker performance in 2015.”

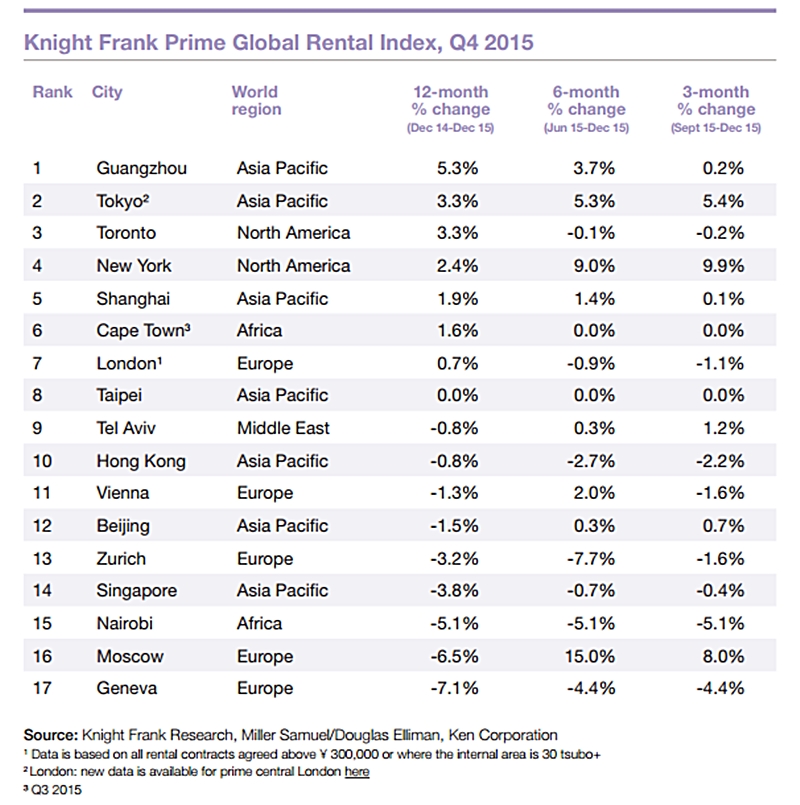

China’s Guangzhou remained the strongest- performing city, recording annual rental growth of 5.3 percent in 2015. This was despite market conditions being favourable for buyers with record low interest rates and a relaxation of financing for second homes and foreign buyer restrictions in China last year.

Geneva in Switzerland displaced Moscow as the weakest performing market during 2015, with rents falling by 7.1 percent annually, the downward pressure on rents being caused in part by strong supply.

Some of the world’s top financial centres have shown divergence in terms of the performance of prime rents. Rents fell in Hong Kong (0.8 percent) and Singapore (3.8 percent), whereas Tokyo, New York and London recorded a rise in prime rents year-on-year of 3.3 percent, 2.4 percent and 0.7 percent respectively.

Last year saw large regional variations in terms of rental performance around the world. North American cities recorded the strongest rise in prime rents, up 2.8 percent on average whilst Europe saw the largest decline, with average prime rents decreasing by 3.5 percent.

Since its post financial crisis low in Q2 2009 the Index has increased by 19 percent. From Q1 2007 to Q3 2008, prior to the financial crisis, the Index averaged increases of 9.1 percent per annum however, post Q2 2009 the average annual change has diminished to 2.5 percent.

On the upside, 2015 saw a partial resolution to the to the ‘Grexit’ crisis and the Asian equity markets stabilised. In 2016, ‘Brexit’ looks to be fuelling further uncertainty within Europe, with business activity hitting a 13-month low, according to the Markit’s European composite Purchasing Managers’ Index. In markets which are already reflecting on negative interest rates, low commodity prices and a slowdown in China, further uncertainty in the world’s key prime rental markets is likely.

The Knight Frank Prime Global Rental Index is an important resource for investors and developers looking to monitor and compare the performance of prime residential rents across key global cities. Prime property corresponds to the top 5 percent of the housing market in each city. The change in prime residential rents is measured in local currency. The Index is compiled on a quarterly basis using data from Knight Frank’s network of global offices and research teams.

Many Southeast Asian cities are not reflected in the chart due to a lack of transparent, accurate and timely data.